News And Information

GST Anger as Western Australia still awaits GST reform

Despite the anger, West Australians are still waiting for its share of the GST distribution to be fixed. Originally proposed as a broad consumption tax by Federal Treasurer Paul Keating ("Keating") in 1985, it was subsequently dropped at the request of Prime Minister Bob Hawke after being approached by the ACTU, welfare groups and business.

In 1991, opposition leader Dr John Hewson declared a GST was the centrepiece of the coalitions 1993 election campaign, but problems soon developed in explaining the policy and this resulted in voter dissention and mistrust across Australia. This mistrust allowed then Prime Minister Keating to argue against the GST, a point I personally found interesting considering he first proposed the consumption tax whilst Treasurer in 1985. Accordingly, Australia's voters re-elected the Labor government (despite the fact the 1993 federal election was seen to be the unloseable election for the coalition).

Elected leader of the Liberal Party in 1995, John Howard ("Howard") said, "there's no way GST will ever be part of our policy" and when further challenged by reporters said "never, ever its dead." In 1996 Howard led the coalition to victory and become our next Prime Minister. Before the 1998 election however, Howard proposed a GST but suffered a swing against the coalition at the election. Again, voter dissention and mistrust reigned, and whilst Labor achieved a two-party preferred vote of 50.98%, the incumbent coalition government's vote was only 49.02%, however retained government as it won a majority of seats in the lower house.

Despite much contention Howard declared the win was a mandate for the GST. Lacking a majority to pass the legislation in the Senate, Howard needed to rely upon the minor parties and independents to both support and pass the necessary legislation.

Howard liaised with the Australian Democrats ("Democrats") and its leader Senator Meg Lees ("Lees") who supported the GST (with some exceptions) by passing the legislation in the Senate. After receiving Royal Assent, the GST was enacted and commenced as of the 1 July 2000.

In promoting the GST, Australians were advised that many State and Territory taxes (including stamp duty) would be removed, and that all revenue raised by the GST would be redistributed back to the states and territories. Also promoted was that no state or territory would be worse off.

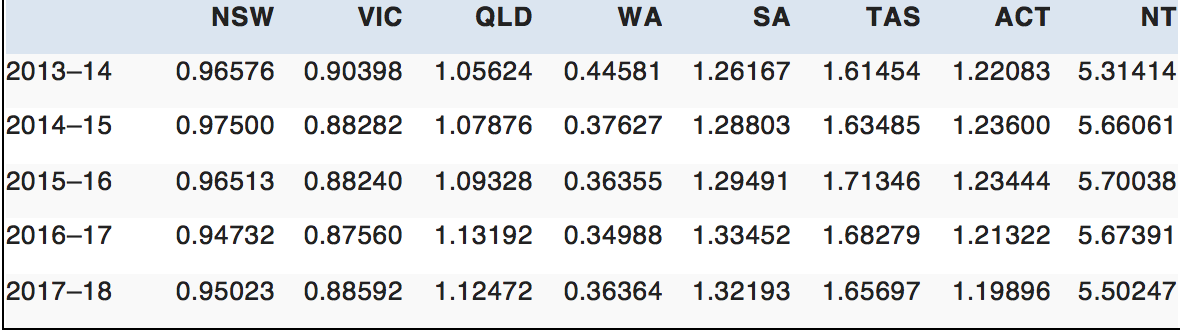

In the 2014/ 15 GST budget review, it was reported that WA's GST share has continued to decline and was estimated to be $0.36364 cents in the dollar in the 2017/ 18 financial year. Therein lies the problem, and the anger of the Western Australian public. This decline has been at the expense of increases to other states and territories as Table 1 clearly displays below see: https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/BudgetReview201415/GST

Table 1: Forecast GST relativities for the states and territories, 2013-14 to 2017-18

Source: Australian Government, Federal financial relations: budget paper no. 3: 2014-15, 2014, p. 92, accessed 19 May 2014.

Whilst former Liberal minister Don Chipp founded the Democrats in 1997 as a political party with the goal of "keeping the bastards honest," the steps taken by Senator Lees and her parliamentary colleagues in aligning with the coalition to pass the GST legislation essentially eroded the publics support and trust in the Democrats, and it would appear this trust has not returned as the party no longer enjoys the position it once did.

Western Australia's Position

Based on the above it would therefore appear the GST has already had a difficult introduction, especially when you consider the statements of our political parties and politicians alike. Furthermore, the circumstances surrounding the GST's original introduction, and the comments by Howard when he declared the election win was a mandate for the GST (when he suffered the swing he did against him) has also been widely critiqued.

One thing for sure is that its Western Australia, and Western Australia alone that's been the worst state effected by the introduction of the GST and its distribution back to the states and territories. Had it been originally reported that WA's share of the GST distribution was forecast to fall, and reduce to only $0.36364 cents in the dollar in the 2017/ 18 financial year, it's clear that the public sentiment, appetite of WA's political parties and politicians alike, let alone WA's business community would never have agreed to the introduction of the GST in the first place.

West Australians feel cheated and are very angry over what has transpired, and all political parties and politicians need to listen to the warnings from the WA public, warnings that have not been heeded to date, and nor have they been taken seriously for many years now.

With news of top up payments being promised because of WA's extremely low GST share distribution, and evidence that even the Productivity Commission believes that the system of dividing GST revenue is broken "beyond comprehension by the public" and that its poorly understood by most within government, it's no wonder my fellow West Australians are angry with the position our state now faces.

West Australians are very astute when it comes to GST, and the position of our state. Further and regarding top up payments, possibly via Commonwealth grants outside the GST process, which have been primarily linked to infrastructure projects (with conditions attached), it's important for our Federal Government and politicians to understand that the State of Western Australia, and my fellow West Australians will not accept conditions on money our state is otherwise already entitled too, including the introduction of "toll roads" as occurred with the Roe 8 development that was rejected by West Australians at our last state election. It is up to the Government and people of Western Australia to determine its future, and as such how it uses money it is otherwise already entitled too, i.e. no conditions and no more excuses.

This is a position that due to the history and treatment of GST, and its associated effects on the Western Australian economy, as alluded to above will not likely change and West Australians look forward to this matter being resolved immediately, as to continue with the current broken and unjust system is an affront to all West Australians.

The problems associated with in Cabinet and Treasury as a result of the GST distribution is also a problem I have personally experienced, as during my time as Head of Procurement at Verve Energy (Government of WA's electricity generator), we had difficulty with finance and had to be careful about increasing state debt, let alone our projects and joint ventures to ensure a reliable baseload power supply was maintained for all West Australians.

GST and its distribution is a matter where all West Australians are prepared to fight. West Australians can no longer allow an unequitable, unjust and broken system to continue any longer as the GST system is in dire need of real reform.

We no longer need a band aid approach to WA's GST share, but a solution, a solution that benefits not only Australia but the entire state of Western Australia, and considering the land mass of our state and its associated infrastructure requirements, those challenges are many and need serious solutions.

If not taken seriously, the position of the West Australian voters will become more rigid in its views of federal politicians and their treatment of WA's citizens, and should that be the case, then be warned and do so at your own peril.

WA has had enough and its time to change, change to correct the unequitable, unjust and broken GST system that we currently have.

Philip Couper