News And Information

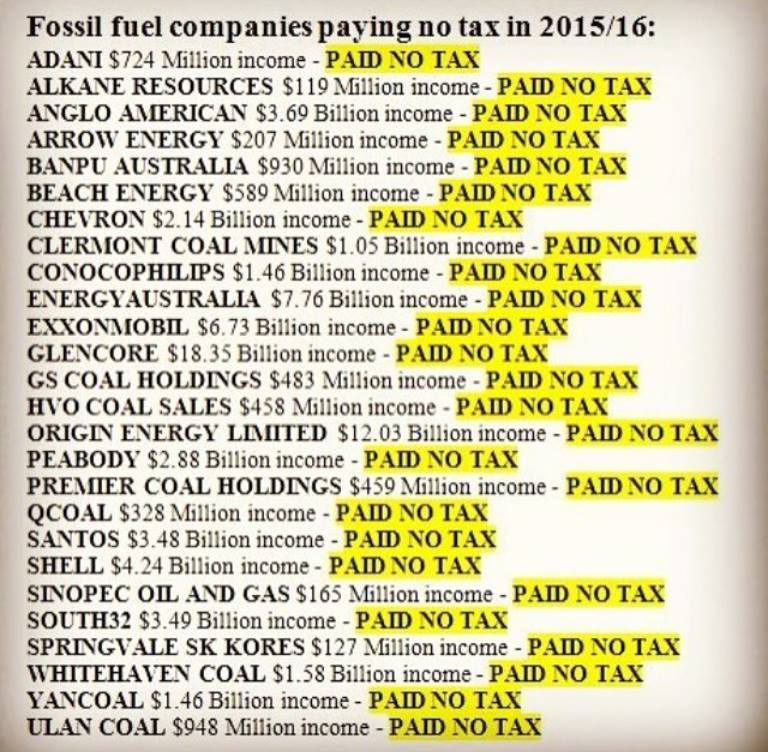

ATO Reports 732 Companies Paid No Tax in Australia

ATO says 732 Companies with income more than $500 billion paid no tax in Australia in the 2015-16 financial year.

With the ATO releasing their corporate tax data (dataset), its noted that there were 732 companies who paid no tax in Australia in the 2015-16 financial year, yet collectively, their income was more than $500 billion.

I, along with my fellow Australians, ask how can this be allowed to happen? With the Australian Government advising that each dollar "Earnt Here is Taxed Here" the figures released by the ATO show a different reality, and the full dataset has been posted by the ABC and is searchable at: http://www.abc.net.au/news/2017-12-07/corporate-tax-data-released-by-ato/9236878?pfmredir=sm

The Dataset consists of:

- This information contains the total income, taxable income and tax payable of more than 2,043 entities;

- They include 1,693 Australian public entities and foreign-owned entities - including privately owned foreign companies - with a total income of $100 million or more;

- They also include 350 Australian-owned private entities with a total income of $200 million or more;

- The information is from Australian tax returns for the 2015-16 financial year; and

- This from the ATO: "As the legislation does not allow for the reporting of an amount of zero or less, these fields are left blank."

Greens Leader Richard Di Natale says Australian democracy is 'broken' and the system is being propped up by the Labor and Liberal parties as he singles out companies that paid no tax yet donated to major parties.

https://www.theguardian.com/australia-news/2017/dec/11/greens-single-out-13-companies-that-paid-no-tax-yet-donated-to-major-parties?CMP=Share_iOSApp_Other

To my fellow Australians, you deserve so much better, and it's time for change Australia. The answer is within our country and the times come for our Federal Government and Politicians to finally represent All Australians and ensure that any income earnt from activities in Australia, must be taxed right here in Australia.

Philip Couper